Last week, spot Bitcoin ETFs saw daily net outflows totaling $713 million, more than threefold the $172.69 million outflows recorded the previous week.

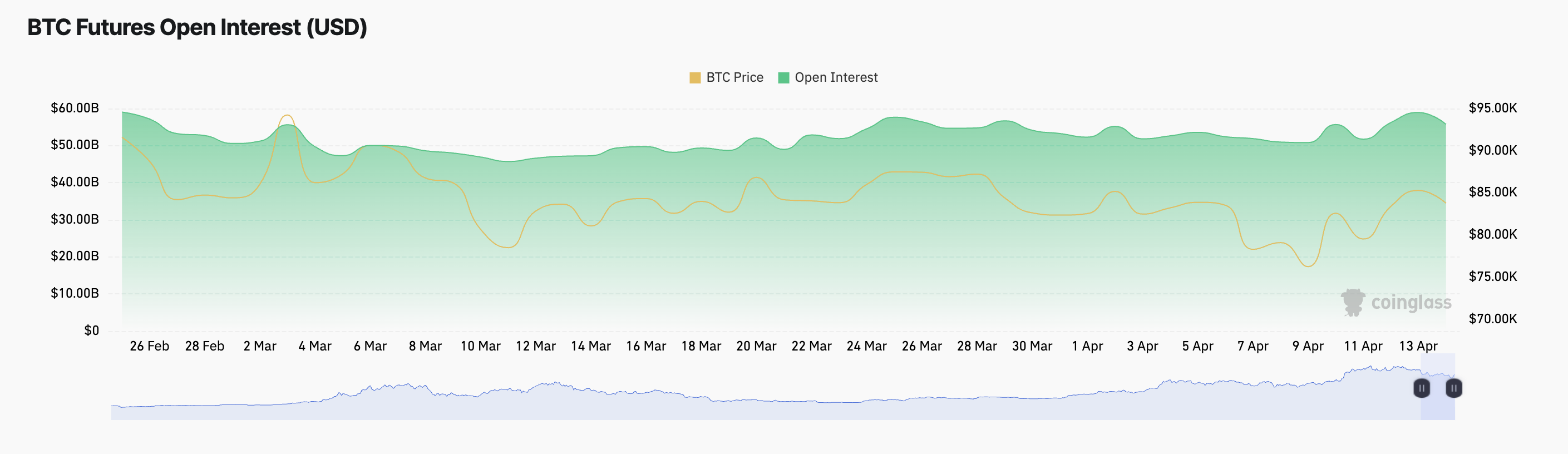

In the derivatives market, BTC’s open interest has started the new week with a decline, although funding rates remain positive.

Bitcoin ETFs Bleed as Market Volatility Shakes Investor Confidence

Between April 7 and April 11, institutional investors pulled a portion of their capital from BTC funds. The move was largely driven by broader market troubles, which kept BTC’s price below the highly coveted $85,000 mark and dragged it down to as low as $74,000 a few times.

During the review period, total net outflows reached $713 million, a 314% increase compared to the previous week’s withdrawals of $172.69 million.

The largest weekly outflow came from BlackRock’s IBIT, which saw $343 million in net outflows, marking 48% of all sums removed. Grayscale’s GBTC followed with $161 million in outflows, bringing its total net outflows to $22.78 billion.

Although the ETF market bled, some funds managed to record inflows last week. Per SosoValue, Grayscale’s Bitcoin Mini Trust saw the highest net inflow among BTC spot ETFs last week, bringing in $2.39 million.

Bitcoin’s Derivatives Market Signals Cautious Optimism

On the derivatives front, BTC’s futures open interest has begun the new week on a downward trajectory.

It currently stands at $55.73 billion at press time, noting a 5% dip over the past day. This is happening amid the broader market’s recovery attempt, which has seen BTC’s value climb by a modest 1% over the past day.

A decline in open interest while BTC‘s price rises signals short-term caution among derivatives traders. It suggests that traders are closing out positions rather than entering new ones.

Despite this, funding rates remain positive, suggesting that long positions still dominate among perpetual futures traders, albeit with a more cautious tone.

Meanwhile, there are currently more put contracts than call contracts in the options market, signaling a bearish tilt in trader sentiment. This higher put/call ratio signals more BTC traders are betting on a potential downside move for the coin or are actively hedging against near-term losses.

The ETF outflows, declining open interest, and bearish options positioning suggest that sentiment in the broader BTC market is cautious.

Although the coin’s funding rate hints that some optimism remains, traders are still preparing for increased volatility in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment